Overview of NBFC Merger

A Non-Banking Financial Company registered under the Companies Act which is engaged in the business of loan & advances, acquisition of shares/ debenture/ bonds or other marketable securities such as hire purchase and insurance business.

NBFC provides working capital loan and credit facilities.

What do you mean by NBFC Merger?

The merger is a combination of two existing entities into one new company. The merger is considered as a corporate strategy of combining two or more NBFCs into a single company in order to enhance the financial and operational strengths of both organizations. Acquiring company acquires the majority of equity shares of one or more companies. Acquired company surrender majority of its equity shares to an acquiring company.

What are the advantages of NBFC Merger?

- Economies of Scale

- Help in growth and compete with Govt. & Multinational Banks and later can move for a bank license.

- NBFC merger helps acquirer to avoid the cost and time-consuming aspect of asset purchases, software development, and such other assignments.

- Tax benefits

- NBFC merger helps in competing with banks.

- Increase market share.

- Increase goodwill & reduce NPA

What are the disadvantages of NBFC Merger?

- Challenges in operation management due to the large scale of NBFC business.

- Creates distress within the employee base of each organization.

- Operational Risk

- Management Issues

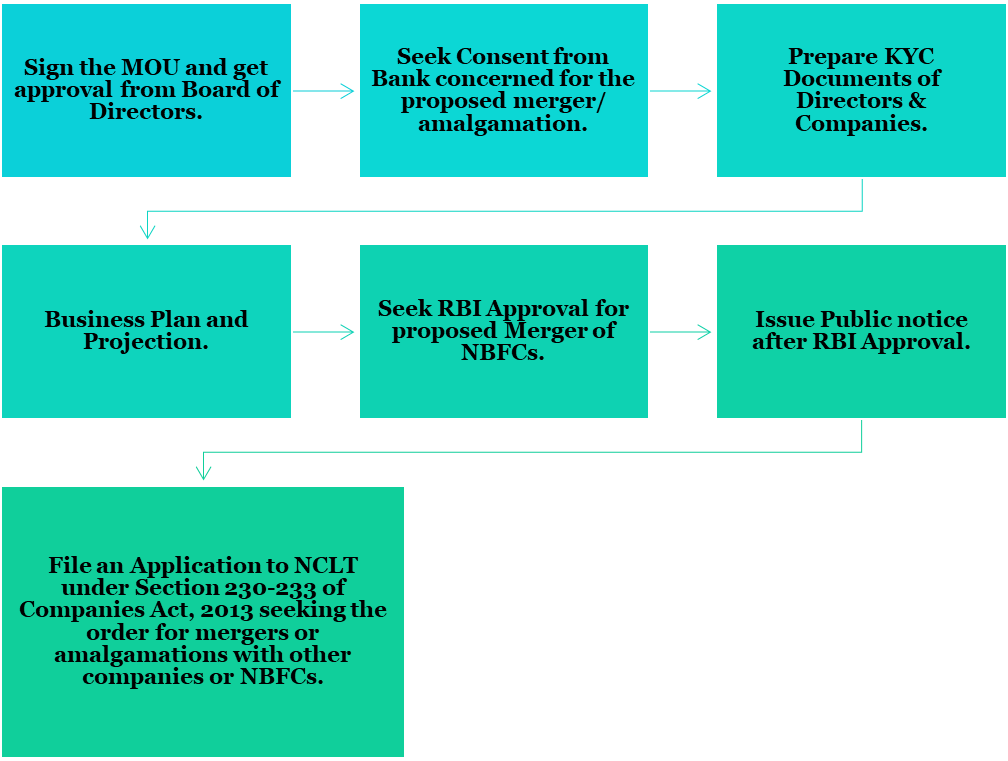

What is the process for NBFC Merger?

What are the documents required for NCLT Application?

- An application is required to be filed with NCLT for the purpose of convening a general meeting.

- Tribunal will pass an order to conduct a general meeting of the shareholders.

- The shareholders meeting will be conducted by the company for the approval of the merger scheme.

What are the Documents Required for NBFC Merger?

Following are the required documents:

- A certified true copy of the latest audited balance sheet and Profit and loss account of transferee company.

- Obtain SEBI approval in case of a listed company

- Prepare the scheme of merger

- Creditor’s list

- Obtain official liquidator report

- Intimation to the regional director

- Valuation report

- Details of the legal proceedings by or against the company

What are the NCLT specification for NBFC Merger?

- Cross questioning on material facts such as the latest financial position, auditors report, and other information.

- Members or creditors or any class of them represented by those who attended the meeting.

- The scheme is in public interest which is feasible and financially viable.

- The scheme is in the interest of the company, its members, and creditors.

What are NBFC Merger Business Model?

- Company (1)Online and offline marketing campaigns will be of much help for Fintech Companies to provide leads. There must be a requirement for a Fintech Company to deposit adequate amounts to the fund manager as FLDG. The fund manager will soak fund in Non-Banking Financial Company as Inter-corporate deposits.

- Company (2)As instructed by the Fintech Company, a consulting company, lawyer, or a CA will be managing the funds. For their respective services, they will be charging a considerable amount of service fees from Fintech Company.

- Company (3)The responsibility of doing loan disbursement and underwriting is in the hands of NBFC, regulated by Reserve Bank. The Fintech Company will share the list that includes those people who are interested in different loan products, and after the risk assessment process, disbursement of NBFC will take place. Taking risk management services and services delivered related to loan management into consideration, NBFC will hold some percentage of revenue. And with the Fintech Company, balance profit will be shared.

What are the Reasons for NBFC Merger with Bank?

As taking the overall requirement to provide credit into account, along with ensuring the economic boost and development of the economy into account, the call for collaborations between an NBFC and a bank is something that requires everyone’s attention.

The main reasons behind this merger are-

- Ensuring sufficient liquidity in the market

- Advancing credit to borrowers

- Meet lending targets in priority sector

- Giving a boost to priority and other sectors

- Increase banking outreach

- Dodge liquidity crisis (Also known as credit crunch)

- Expand and augment financial inclusion

What is the Compliance Requirement for the NBFC Merger?

- The verification process of ID, Aadhaar of the borrowers, and PAN Card verification gets completed online

- Maintain and store records of borrowers’ data for five years

- Getting live snaps of the borrowers

- After loan agreement get executed, pay E-stamp duty

- In the case of loan inquiry, delay, disbursement or default, the requirement is to report to credit information companies

- Conform to the CKYC norms as stated by the Reserve Bank of India

- Comply with TDS, GST, RBI Act as well as Companies Act

- Based on 45 days or 90 days Loan book performance norms, bring out the provisions for NPA.